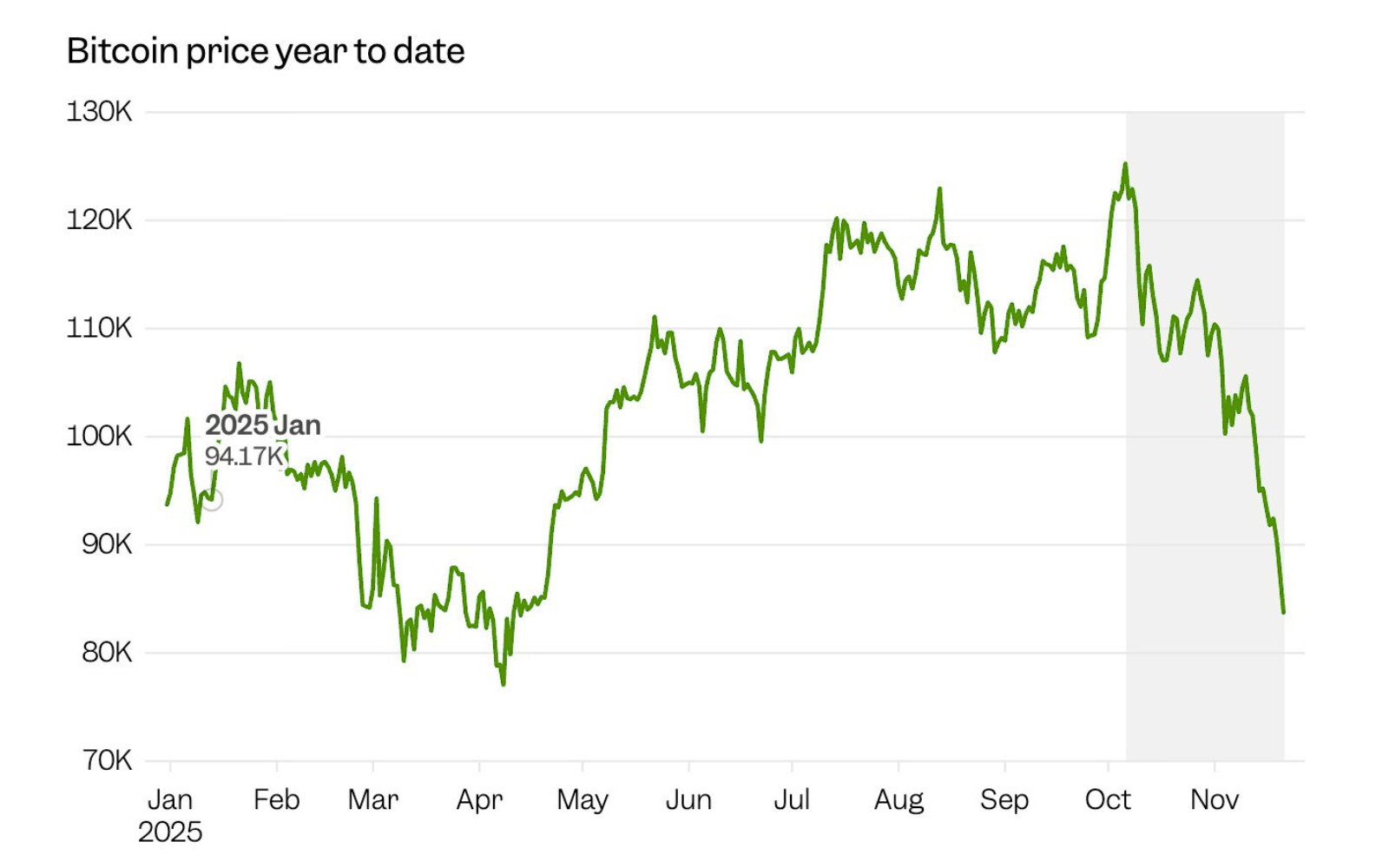

Cryptocurrency investors are not happy campers these days; Bitcoin is experiencing its worst sell-off since 2022, down more than 30% from recent highs. Another popular crypto token, ethereum, has fallen by about 40% from its August peak.

Analysts say the spiral is feeding on itself, through forced liquidations, similar to margin calls in the stock market. Speculators take a 10X leveraged position in bitcoin, which means they own 11 times what they actually invested in cash. A mere 10% downward movement in the token’s value means that the lender can liquidate the ‘investor’s’ position in a forced sale at the lower price. Panic selling adds to the spiral.

Investors whose portfolios don’t include crypto positions might be inclined to shrug their shoulders. How does that affect me? But, in fact, it probably already has already affected people with stock holdings.

Around the same time that the crypto markets were crashing, the Dow Jones index was up 700 points, only to suddenly reverse itself in the early afternoon and end the day down 300 points. There was no explanation in the day’s economic news or earnings reports, but some economists noted that the rout in bitcoin was forcing some investors to sell their stocks in order to shore up their liquidity against crypto margin calls.

In other words, when crypto falls too far, too fast, it triggers stock selling that otherwise wouldn’t have happened, putting downward pressure on prices. Some have speculated that experienced traders have begun watching the cryptocurrency movements for signs of speculative fever—meaning that even without forced sales, a crypto bear could lead to stock dips.

Does that mean if/when bitcoin, ethereum and other crypto coins recover, the stock market will be buoyed accordingly? Probably not. This dynamic appears to be a one-way influence, and right now it’s not helping stock investors.

Sources:

Access our comprehensive, unbiased financial guides here.